Buying a home in Arizona? You probably have one big question swirling in your head: "How long will this take?" It's a good question, and like most things in real estate, the answer depends. From inspections and appraisals to title transfers and financing, there's a lot that can affect your timeline. Let’s break it all down so you know what to expect—without the fluff.

What’s the Average Home Closing Time in Arizona?

If you’re looking for a quick stat, here it is: average home closing time in Arizona typically runs 30 to 45 days after a contract is signed. But that’s only part of the picture.

According to Best Real Estate Market, most buyers and sellers in Arizona can expect closing to take up to a month and a half, assuming there are no hiccups along the way. That doesn’t include the time the home spends on the market before you even get to the signing table.

How Long Does a House Sit on the Market First?

This varies by location and time of year. According to Clever Real Estate, the average total time to sell a home in Arizona is about 92 days. That includes 57 days on market and another 35 days to close.

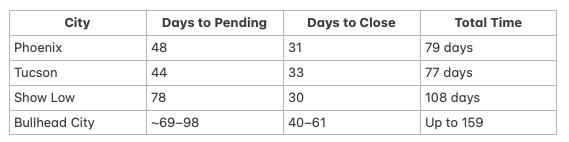

Phoenix: 48 days to pending, 31 to close (GOBankingRates)

Tucson: 44 days to pending, 33 to close

Show Low: 78 days to pending, 30 to close

Timing also shifts with the seasons. March is your best bet for a quick sale—homes average just 51 days on the market in that month.

Factors That Affect Your Closing Timeline

So why can’t we just pin down a number and call it a day? Because several moving parts can speed things up—or slow them way down.

1. Home Inspection Delays

Inspections are typically scheduled within 5-10 days of the contract being signed. But if the inspector finds issues, repairs can push back your timeline. Even minor fixes might require back-and-forth negotiation.

Tip: If you’re selling, get a pre-listing inspection. It'll catch problems early and save time.

2. Appraisal Complications

Appraisals are usually ordered by the buyer’s lender and must match or exceed the sale price. If the appraisal comes in low? You’ll need to renegotiate—or walk away.

This part typically takes 7–10 business days but can delay closing if the numbers don’t line up.

3. Title and Escrow Services

Title companies research the property’s history to make sure it’s free of liens or legal issues. This part is pretty standard, but title issues (like old unpaid taxes or incorrect property records) can stall the deal.

Expect about 10–14 days to clear the title, assuming everything checks out.

4. Financing Hiccups

If you’re buying with a mortgage, your lender needs to process everything—income verification, credit checks, debt-to-income ratios. This is one of the biggest wildcards.

Pre-approved buyers may move faster. But if a document is missing or a financial red flag pops up, it could take weeks to resolve.

5. Contingencies in the Contract

Some contracts include contingencies, like selling your current home first or finalizing financing. These conditions can stretch your timeline depending on how quickly they’re resolved.

6. Buyer or Seller Schedule Conflicts

Believe it or not, one of the most common causes of last-minute delays? People’s calendars. If the seller’s out of town or the buyer’s job won’t allow time off, that signing date might have to wait.

Arizona-Specific Considerations

Arizona’s closing process has its own quirks. Here’s what stands out:

Buyers typically pay 2–5% of the sale price in closing costs (Best Real Estate Market).

Sellers can expect to pay more—6–10% of the sale price.

Closing doesn’t usually happen around a big table. Most Arizona closings are handled by escrow agents, with parties signing separately.

How Do Arizona Cities Compare?

Want to know how your city stacks up? Here’s a quick look:

According to HomeLight, Bullhead City tends to have some of the slowest timelines in the state.

The Federal Reserve Bank of St. Louis also tracks median days on market for the Phoenix-Mesa-Scottsdale area. As of May 2025, it’s 58 days—a sign of relatively stable demand.

Can You Speed It Up?

Absolutely. Here’s how:

Get pre-approved for a mortgage before house hunting.

Respond fast to requests from your lender, agent, or title company.

Avoid big financial changes, like taking out new credit cards or switching jobs mid-deal.

Work with experienced professionals who know how to keep things moving.

You won’t control everything, but being organized gives you a serious advantage.

The Bottom Line

So, how long does it take to close on a home in Arizona? Here’s the short version:

Plan for about 30–45 days once you're under contract.

Expect another 40–60 days (depending on location and time of year) for the home to go under contract in the first place.

Factor in variables like inspection issues, title searches, and financing delays.

Whether you're buying in Tucson or selling in Phoenix, the process takes time—but knowing what to expect can make it feel a lot smoother.

About the Author:

Brooke Lazor

Brooke is a seasoned PR professional with over 8 years of experience in the field. Brooke has a proven track record of securing top placements in major publications for the companies she has worked for, including Forbes, The Wall Street Journal, and Bloomberg News